Test Case For Credit Card Application Processing System: In this post, we will write a test case about the credit card application processing system. Before writing any test scenario as a QA or tester, you know the product or application.

For writing credit card testing scenarios, one person must know the banking domain, or you must gather knowledge on banking domain projects. As we write the test cases for the Credit Card Application Processing System, it’s difficult to discuss all the domain concepts in detail. But we are trying to share some of the concepts like:

- How does credit card processing work?

- credit card processing fees

| Post On: | Test Case For Credit Card Application Processing |

| Post Type: | Test Case Template |

| Published On: | www.softwaretestingo.com |

| Applicable For: | Freshers & Experience |

| Join Our: | Telegram Group |

How does credit card processing work?

If you’re paying in-store, swipe your magnetic stripe card, dip your EMV chip card, tap your contactless card, or use a digital wallet like Apple Pay. If you’re paying online, enter your credit and debit card information through the website or app. You can use a virtual terminal to process credit cards for phone orders securely.

When you provide your payment information, it is sent to the processor, who will communicate with your bank through the appropriate card networks. Your bank will approve or deny the transaction based on factors such as whether your card number is valid, if you have enough funds and other considerations.

After you’ve swiped a customer’s credit card, the approval for the charge is sent back to your payment processor. If approved, the transaction will be batched for settlement at the end of each business day. The customer’s account will then be charged, and a deposit will be made into your merchant bank account.

What Are credit card processing fees?

Credit card processing fees are the charges a merchant pays for each credit or debit card sale. Your merchant services provider sets these fees and typically includes three parts: interchange fees, assessment or service fees, and the payment processor’s markup.

Suppose you only see a convenience fee for credit card purchases, not debit card purchases. In that case, it is because debit cards have a different pricing model that usually costs less for merchants.

UI Credit Card Test Cases

- Check whether the bank appears over the credit card.

- Check if the logo of the respective bank is displayed.

- Check the type of the credit card logo is displaying properly. Example: Visa, Mastercard.

- Check if the credit card number is displayed clearly.

- Check if the expiration date is visible.

- Check whether the CVV number is displayed clearly on the backside of the card.

- Check whether the user name is displaying properly.

- Check if the color of the credit card is as per the requirement document.

- Check if the credit card size (length & width) meets the requirement.

- Check that the Wi-Fi symbol is displaying properly on the credit card.

- Check if the magnetic stripe width is displaying as per the requirement.

- Check if the Hologram is displaying over the card.

- Check if the weight of the cards is as per the document specification.

Test Cases For Credit Card Payment

- Check the maximum credit limit of the card.

- Check the maximum withdrawal limit of the credit card.

- Check whether international transactions are allowed on the card or not.

- Check whether domestic transactions are allowed or not.

- Check if the user can withdraw cash using the credit card or not.

- Check users can withdraw cash by using a valid PIN.

- Check that the user can withdraw cash by using an invalid PIN.

- Check that you can void a payment before posting it and that after posting a payment, voiding is not allowed.

Negative Credit Card Testing Scenarios / Negative Test Cases for Credit Card Payment

- Check if the user can perform the transaction with an invalid PIN.

- Check the user should not allowed to perform any transaction after the maximum limit.

Test Case For Credit Card Application Processing

- Check the valid card number and check whether the Credit Card is valid.

- Check for the expiry month and expiry year.

- Check whether the three-digit CVC pin is valid or not.

- Check with an invalid card number

- Check with an invalid CVC number.

- Check for the valid user(number).

- Check for his/her last login (whether that falls within the quota, the date after his bill was sent)

- Check for the balance amount that he can access from the allowed one(say Rs.10,000 or 50,000 and the amount that he/she needs for the current transaction.

- Check for the Account holder’s Name on the Credit Card

- Check for the expiration date on the card.

- Check with past expiration months and year

- Check card field accepts characters

- The amount will be detected only when all the details are correct

- If any card details fail, it should throw an error message

- The transaction will be declined when a card does not have enough balance in its account

- Checking with a valid card and valid PIN.

- Checking with a valid card and an invalid pin

- Checking with invalid cards and pin

- Check how much the balance on the Card is.

- Check the Credit Card Verification number on the card.

- Check for the Credit Card Payment Due Date

Manual Test Case Buying a Mobile Phone Through Credit Card

Question: Write the test cases for the given scenario. The customer wants to buy a music album and checkout with a credit card.

While answering this question, we as analysts need to make some assumptions, so I better ask the interviewer about some assumptions I am considering here. Otherwise, test cases will also vary depending on the scenarios your interviewer asked you.

- Assumption: 1. We have to write the test cases for only the mobile application, not a web-based application.

- Assumption: 2. The customer has a Music app installed already, like Gaana, Sawan, etc.

- Assumption: 3. The customer has already created an account using an email ID/username and password. At this point, the user can successfully log into their account.

Test Cases Buy Music Album And Checkout With Credit Card

- Verify the user can successfully log in to the account using their username and password.

- Verify that the user can search for the album name, artist name, or any other keywords for that album using the search button.

- Download(View details about Subscription plans/Packages)

If the user is already a paid subscriber, clicking the Download button should allow the user to download the album. The downloaded album should come under the download category in the user’s profile.

II. If the user is not a paid subscriber, on clicking the Download button, the user should get redirected to the next page of “Subscription Plans and Packages” of the app. - Buy Now/ Payment- different Modes of payment.

If the user clicks the Buy Now option, the user should get redirected to the next page, “Choose Mode Of Payment.”

II. Verify the user can click on different modes of payment, like

a. Credit Card

b. Debit Card

c. Internet Banking

d. More options - Choose credit card for payment- Full payment process

As the interview question concerns the credit card, I will write the test cases for a credit card.

I. Verify that the user can get the “Add New Card.”

II. Verify the user can fill in the following details.

a. Cardholder name

b. Card number

c. Expiration Date

d. Billing address

III. Verify the card number is within the range and length of the valid card number.

IV. Verify the cardholder’s name is within the English alphabet range.

V. Verify that the Expiration date is in the valid date format.

VI. Verify that with all the valid inputs, the user should be able to add the credit card details by clicking “Submit.”

VII. Verify with even one of the invalid inputs that the user should get an error message stating the message about the invalid input provided. The user should not be able to click the “Submit” button.

VIII. On clicking “Cancel,” the user should be able to cancel the Payment screen and be redirected to the Home screen. - Verify once the user has successfully added the card details.

I. The user is given the option to make a payment using an existing card or by any other mode of payment.

II. If the user chooses the option to make the payment using the existing card, verify there is an option to enter the CVV number

III. Verify that the user should get an option to enter OTP upon entering a valid CVV number. On entering the valid OTP, the user should get a confirmation message of “Order Placed.”

IV. If the user enters the wrong CVV number and enters the correct OTP, the user should get an error message saying “Payment Failed” due to the wrong CVV number.

V. If the user enters the correct CVV number but enters the wrong OTP, the user should get an error message saying “Payment Failed” due to the wrong OTP. - Verify that the album is available offline by switching off the Wi-Fi and mobile data.

Negative Test Cases

- Download failed/interrupted

I. Start the download, and when the download is in progress, turn off the wifi and data of the mobile to interrupt the download.

II. Verify the user can delete the failed downloaded file.

III. Verify the user can re-download it without paying for it again. - The offline album got deleted.

I. Delete the downloaded song and verify the song/album is deleted.

II. Download the song/album again, and verify the user can download the deleted song/album. - The payment failed- The payment can fail due to a lot of many reasons like:

I. Wrong CVV number entered

II. Wrong OTP entered

III. Delay in getting OTP on the registered mobile number

IV. Delay in getting a response from the Bank server

V. Internet issues

VI. Others

The user should get an error message stating the reason for the “Failure of Payment”. - No space on the device where the album is downloaded- Verify the user is getting an error message stating, “There is not enough space in the device to download the album; please try again”.

- Blocked card- If the user has entered all the inputs in the correct format for the credit card, it’s a “Blocked card”.

The order should be placed, but the user should get a payment failure notification once the bank confirms it.

II. The placed order should go on hold.

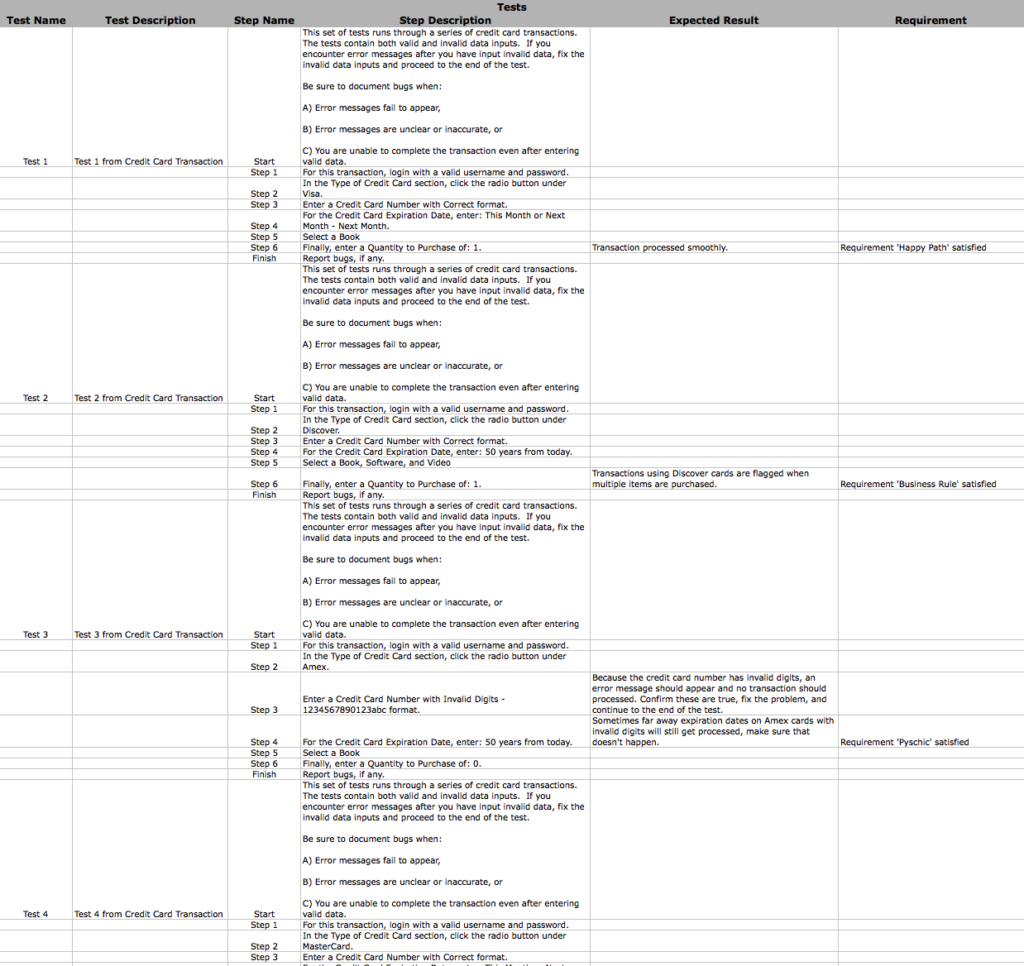

Test Cases For Credit Card In Excel

We have tried to share some of the credit card test cases in Excel. You can see the below image.

Feel free to let me know if you have any other test cases to be considered. You can also submit additional test cases in the below comments. Feel free to suggest additional test case-related questions in the comments. I’d appreciate it if you shared this article on social media or forums.

Thanks for the great article on credit card

Thanks For this detailed test scenario

Can you share the test scenario in Excel sheet

where they posted in excell?

thanks for sharing the detailed test cases on credit card

The article is very useful for testers.This gives an idea on how deeply we have to think on a product as QA / Tester to deliver best product to the client with continuos service.