Test Cases For Banking Application Or Test Cases For Banking Application In Excel Sheet Download: The banking industry is a critical component of any economy, and the success of this sector largely depends on the efficient and effective functioning of the banking software. Given the growing competition in the banking industry, banks must ensure that their software is reliable, secure, and user-friendly to attract and retain customers.

Test cases play a vital role in achieving this objective by identifying defects, faults, or flaws in the banking application software. Therefore, in this article, we will discuss the importance of test cases in ensuring the functionality and performance of banking software and explore some of the essential elements of a test case for banking application software.

| Post On: | Test Case For Bank Application |

| Post Type: | Test Case Template |

| Published On: | www.softwaretestingo.com |

| Applicable For: | Freshers & Experience |

| Have You Joined: | Our Telegram Group |

So, it is hard to generalize the flow for all the banks. So, I am attempting to develop a stream most banks will likely have in their money transfer process. You may find a lot of differences depending on the type of bank you are using.

But before starting to write the test cases for banking applications, you have to understand the following things:

What is Internet Banking?

In Internet banking, both customers and organizations use an electronic method for money transfer using a web application. Currently, in the 21st century, most people are using this method for money transfer because it’s faster and because there is no need to wait a long time in the queue to do a single transaction.

Using this method, you can able various operation-related money transfers like receiving money, paying bills, and many other operations. But when dealing with any bank application, the developer and testers ensure the app runs smoothly on all browsers and devices. The web application also secures all cyber threats, and the performance doesn’t decrease during peak business hours.

How do you validate a banking application?

To validate a banking application, you must perform various tests to ensure that the application is functioning correctly and meeting the requirements. Some general steps to follow when validating a banking application include:

- Review the requirements: Review the requirements for the application to ensure that you understand what the application is expected to do.

- Create a test plan: Develop a plan that outlines the tests you will perform on the application. This should include the test cases you will run, the data you will use, and the expected results.

- Set up a test environment: Set up a test environment that mimics the production environment as closely as possible. This will allow you to test the application under realistic conditions.

- Run the tests: Execute the tests outlined in your test plan and record the results.

- Analyze the results: Review the results of the tests to determine whether the application is functioning correctly.

- Report the results: Document the tests’ results and any identified issues. This will help the development team identify and fix any problems with the application.

- Repeat as needed: Depending on the complexity of the application, you may need to repeat this process multiple times to ensure that the application is thoroughly tested and validated.

Bank Application Testing

There are several aspects QA specialists prioritize when testing any Bank Application:

- Functionality Testing: All modules are working as expected (both as an independent element & after integrating all separate modules)

- Usability Testing: Most of the time, those using banking applications are not proficient PC users. So, the form should be clear and have a user-friendly interface for them.

- Performance Testing: As this is developed for the users, the application’s performance should be faster. And the app should be working correctly on various platforms.

- Security Testing: People will use a banking application for money transfers. So, one of the high-priority tasks for the organization is to develop the app in such a way that it meets standard security guidelines.

So in this post, we are going to discuss the natural flow of the Bank Application with some basic scenarios:

Test Steps for Bank Transactions

So here are the necessary steps that we follow when we perform any currency transfer operation:

- Go to the bank website login page.

- Input username and password.

- Go to the money transfer page.

- Add the beneficiary to whom you want to transfer money.

- Check the details of the bank account and person. Verify if they are correct.

- Select the specific money transfer method from NEFT/RTGS or SWIFT options.

- Select the beneficiary name and funds, and then submit the details.

- Verify the amount and other details on the verification page.

- Click submit for the final action of the fund transfer.

Whatever steps you see above are the fundamental flow we cover here. And maybe if you go to another region, it may differ from the above scenario.

For example, some of you may have SMS authentication before sending the money. Some of you will likely have other means of verifying the beneficiary details to avoid sending the money to the wrong person. But in most of the banks, the flow is pretty much the same for most banks.

Test Cases For Banking Application – Net Banking Application

Here are some test cases for a net banking application:

- Verify that the user can successfully log in to the net banking application using their correct login credentials.

- Verify that the user cannot log in to the net banking application if they provide incorrect login credentials.

- Verify that the user can reset their password if they have forgotten it.

- Verify that the user can view their account balance and transaction history.

- Verify that the user can view and download their account statements.

- Verify that the user can transfer funds between their accounts.

- Verify that the user can transfer funds to a beneficiary they have added to their account.

- Verify that the user can make bill payments through the net banking application.

- Verify that the user can set up and manage standing instructions for recurring transactions.

- Verify that the user can set up and manage alerts for their account.

- Verify that the user can update their personal information, such as their contact details and address.

- Verify that the user can request a new checkbook or debit card through the net banking application.

- Verify that the user can block their debit card if lost or stolen.

- Verify users can view and download tax-related documents, such as Form 16.

- Verify that users can view and download investment-related documents, such as mutual fund statements.

- Verify that the user can view and download loan-related documents, such as loan statements and repayment schedules.

- Verify that the user can view and download insurance-related documents like policy documents.

- Verify that the user can access and use any additional features or services the net banking application offers, such as investing in mutual funds or purchasing insurance products.

- Verify that the user can log out of the net banking application securely.

- Verify that the net banking application can handle multiple users accessing the application simultaneously without any issues.

Test Scenarios For Banking Application – Admin module

Here are some test scenarios for the admin module of a banking application:

- Verify that the admin can add, edit, and delete user accounts.

- Verify that the admin can view and update user account information, such as contact details and addresses.

- Verify that the admin can view and update user transaction history and account balance.

- Verify that the admin can block and unblock user accounts.

- Verify that the admin can reset user passwords.

- Verify that the admin can create and manage user groups and assign privileges to each group.

- Verify that the admin can create and manage beneficiary accounts.

- Verify that the admin can view and update the status of beneficiary accounts.

- Verify that the admin can view and update the transaction history of beneficiary accounts.

- Verify that the admin can block and unblock beneficiary accounts.

- Verify that the admin can create and manage vendor accounts.

- Verify that the admin can view and update the status of vendor accounts.

- Verify that the admin can view and update the transaction history of vendor accounts.

- Verify that the admin can block and unblock vendor accounts.

- Verify that the admin can create and manage employee accounts.

- Verify that the admin can view and update the status of employee accounts.

- Verify that the admin can view and update the transaction history of employee accounts.

- Verify that the admin can block and unblock employee accounts.

- Verify that the admin can create and manage account types and assign privileges to each type.

- Verify that the admin can view and update the status of account types.

Banking Application Test Cases For Customers & Visitors

- Check that all the Customer and Visitors module links are working as expected.

- Check all the customers can log in with their valid credentials.

- Check if the Customer cannot log in with an invalid date.

- Check after the number of unsuccessful account accesses; the user account should be locked for that day.

Manual Test Cases For Banking Application – Add A Beneficiary

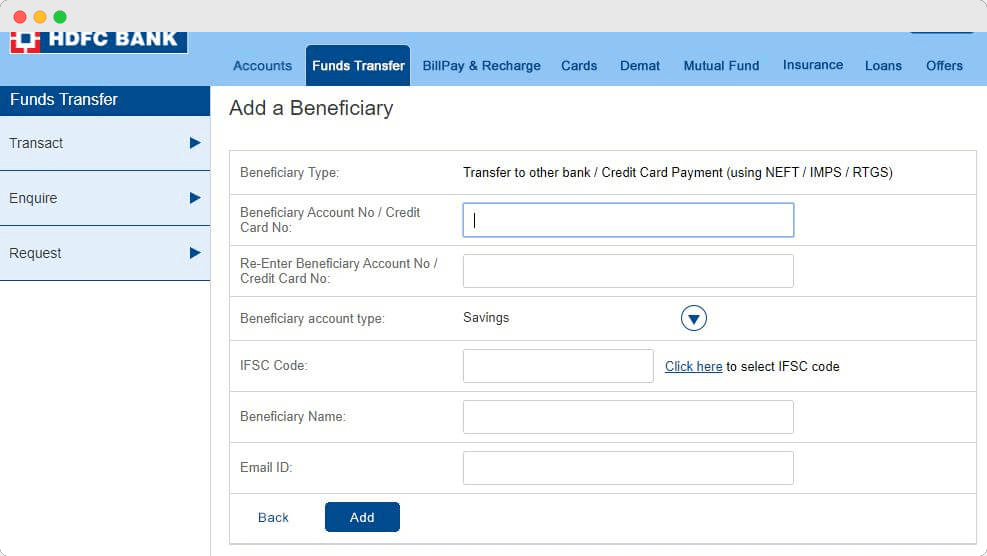

Whatever fields you see in the image below may vary from bank to bank. So, the picture below shows the number of fields you can validate and write test cases for.

Here are some manual test cases for adding a beneficiary in a banking application:

- Verify that the user can access the “Add Beneficiary” feature from the main menu.

- Verify that the user can correctly enter the beneficiary’s name, account number, and bank details.

- Verify that the user can select the type of account (e.g., savings, current, etc.) for the beneficiary.

- Verify that the user can save the beneficiary’s details successfully.

- Verify that the beneficiary’s details are displayed correctly in the beneficiary list.

- Verify that the user can edit the beneficiary’s details if necessary.

- Verify that the user can delete the beneficiary from the list if needed.

- Verify that the user can transfer funds to the beneficiary successfully.

- Verify that the user can view the transaction history for transfers to the beneficiary.

- Verify that the user can receive notifications for successful or failed transfers to the beneficiary.

Note: These test cases are just a starting point, and the actual test cases for a banking application may vary depending on the specific requirements and functionality of the application.

Money Transfer Test Cases

A transfer feature allows users to transfer money from one account to another. Some possible test scenarios for a money transfer feature include the following:

- Verify the bank website URL.

- Verify if the bank website URL has HTTPS on the address bar and in the URL.

- Verify if the bank website login page does not appear forged.

- Verify if the bank login page has a username and password.

- Verify whether the username and password are being accepted or not.

- Verify if the SMS authentication is triggered after login.

- Verify if the user is redirected to the dashboard after passing all authentication processes.

- Verify if the user has access to the online money transfer feature.

- Check if the user can transfer funds option is available during the specific period (9 am to 5 pm).

- Check if the fund transfer option shows notice for off-business hours transactions.

- Verify if the user can add the beneficiary.

- Verify if the beneficiary details can be verified.

- Verify if the fund transfer option allows NEFT or RTGS for nationalized money transfers.

- Verify if the fund transfer page asks for the beneficiary name, IFSC code, bank name, fund amount, and purpose of the transfer.

- Verify if the fund transfer page asks for a PAN number if the number of funds gets over 50k.

- Check if the fund transfer page has a 2-step authentication before you finalize the transfer.

- Check if the interbank fund transfer happens instantly or not.

- Check the time it takes for the funds to be transferred between in-business hours.

- Check the time it takes for the funds to be transferred between business hours.

- Check if the amount transferred notification is sent to the sender and receiver.

- Check if the amount gets transferred to the exact person mentioned in the beneficiary.

Banking Application Test Cases – New Branch

Apart from this flow, there are a few other scenarios we have now added to this post. I hope that also gives you some idea about writing a banking application test case.

- Check With valid data, and you can create a new branch.

- Check with invalid data. You are not allowed to add a branch.

- Check to try to create a new branch with the existing test data.

- Check whether the reset, cancel & submit buttons are working as expected.

- Try to Update branch details with valid and invalid test data.

- Try to update branch details with test data.

- Update branch details with existing branch test data

- Check whether the cancel button is working or not.

- Check branch deletion is allowed with and without dependencies.

- Check that the user should be able to search and locate the Branch.

Test Case For Banking Application In Excel Sheet – New Role

Let us see some sample test cases for banking applications adding a new role.

- Check whether you can create a new role with valid data or not.

- Check if you can create test data without test data.

- Verify new role with existing test data

- Check the role description and role types.

- Check the Cancel & Submit is working as expected or not.

- Check if you can delete a role without dependency.

- Check all the links to the new role are working as expected.

If you want to add a few more points, let us know about those. Now, we will move towards other test cases for banking applications in the Excel sheet of adding new users.

Test Cases For Banking Application In Excel Sheet – Adding New Users

- Check if you can add a new user with valid data.

- Check correct validation messages are displayed by entering invalid data.

- Check after adding a user; correct branch details should display.

- Check all the links are working as expected.

- Check all buttons are working as expected.

- Check validation messages show when invalid data are entered while updating user details.

- Check the Warning message when you click the submit button without changing any details during an update.

- Check whether the user functionality is working as expected or not.

Test Cases For Banking Application In Excel Sheet – New Account

- Check all the mandatory fields and their corresponding validation messages.

- Check all the optional fields and their corresponding validation messages.

- After filling in all the required fields, click the submit button and check whether the new user has been added.

- Check whether the updated balance displays after depositing the amount in the account.

- Check whether the user can withdraw the amount or not.

- Check after withdrawing the amount whether the balance is updated or not.

- Check all the inputted details appearing in the user profile section.

- Check if any primary account is provided or not when that’s a secondary account.

- Check whether or not the company details are provided if that’s a current account.

- Check whether the proof is provided if that’s a joint account.

- Check that a zero account is maintained in a salary account.

- Check if you can maintain zero or less than the minimum balance for a non-salary account.

Test Cases for Bank Account Number Field

To test a bank account number field, follow the below steps.

Bank Account Number: SSSSXXNNNNNNNN (e.g. 35010100008033)

- SSSS– The first four digits of your Account Number are the Service Outlet ID [SOL ID]

- XX-The fifth & sixth digit of your Account Number denotes the Scheme Type (01-09).

The various Scheme Types are:

01 – Savings,

02 – Current Account

03 – Term Deposit

04 – Overdraft

05 – Cash Credit

06 – Loans

07 – Packing Credit

08 – Inland Bills

09 – Foreign Bills

81 – FI Accounts under SB 150

NNNNNNNN – The remaining -8- digits denote the running serial number.

Sample Test Cases for Bank Account Number Field

- Check the accounting field by entering a valid account number.

- Check the accounting field by entering an invalid account number.

- Check the account number field by entering an account number of more than 14 digits.

- Check the account number field by entering an account number of fewer than 14 digits.

- Check the account number by inserting 14 zeros.

- Check if the accounting field is allowing alphabets and special characters.

- Check the account number field by entering the alphanumeric value.

- Check if the account number field is allowing a blank value.

- Check if any warning message is displayed by entering an invalid account number.

- Check if any message shows when the user enters an account number that does not exist.

- Check if the user can paste the account number in the account number field.

- Check that when users enter any closed account number.

- Check that when the user enters an account number with a blank space in between.

Conclusion

I hope we can cover the basic test scenario of the Bank Application. While going through the above scenario, if you find any missing test cases of bank applications, you can mention those scenarios in the comment section.

If you want to contribute something to Softwaretestingo.com regarding bank applications or any other topics or tools, you can write to us at softwaretestingo.com@gmail.com.

First of all big appreciations to entire team for providing ample information about banking domain related test step.

recently i have placed in banking domain project for SMS Delivery to customer through both Mobile SMS and EMAIL

Kindly provide relevant information

This is so enlightening. I am so privileged as a beginner to come across this easy to understand document/article on test cases.

thank you so much for sharing.